Use Tomorrowize Tasty Future Index to Track This Theme

Point 1: We All Like to Dine Out, Aren’t We

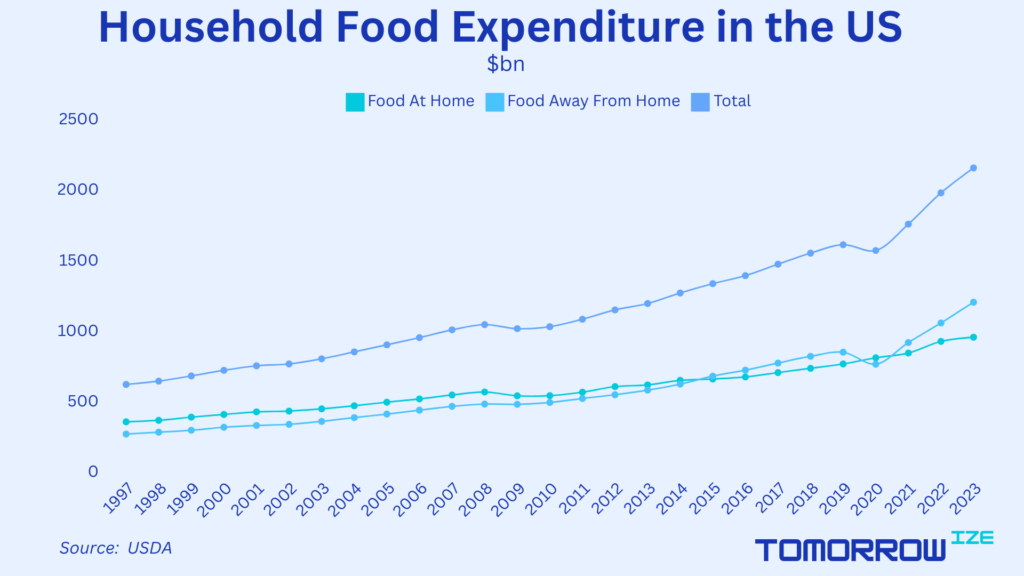

While cooking at home can be an enjoyable activity, it often proves to be time-consuming and yields inconsistent results. The convenience of having meals prepared and served, bypassing the need for grocery shopping, meal planning, and cooking, is a significant appeal for many. Moreover, busy lifestyles and extended working hours leave limited time for home cooking, prompting many to choose dining out as a quicker, more efficient alternative. It’s notable that the consumption of restaurant food surpassed home cooking back in 2014. While the coronavirus pandemic temporarily boosted home cooking due to lockdowns, restaurants are now experiencing renewed growth, leaving home cooking significantly behind. This shift highlights a clear preference for the convenience and experience that dining out offers.

Point 2: Food Delivery Makes Cooking Even Less Appealing

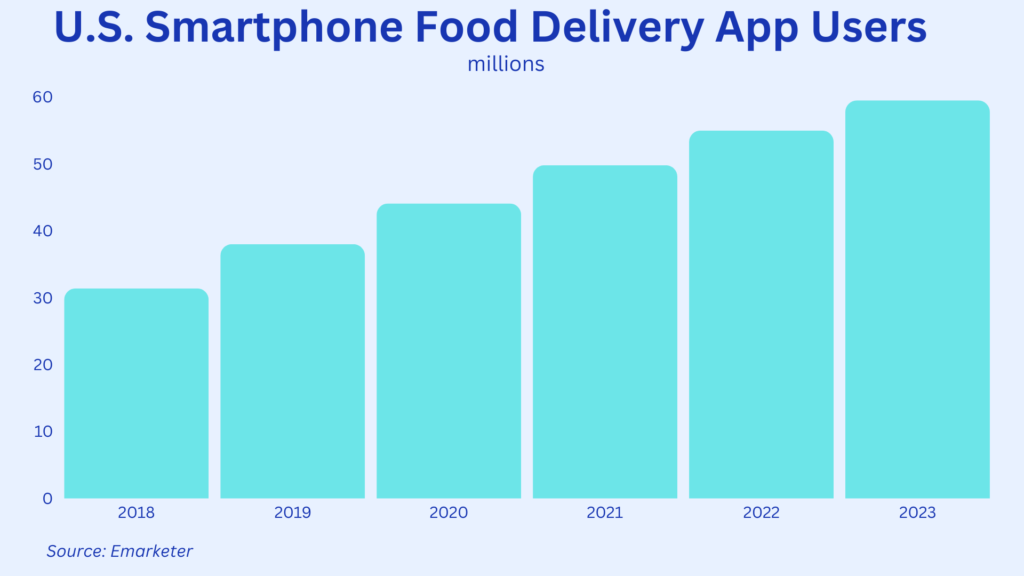

Delivery apps have significantly bolstered the growth of restaurant food consumption by making it incredibly easy for consumers to order meals with just a few taps on their smartphones. These platforms eliminate the need for customers to visit restaurants physically, thereby saving time and effort. They also provide access to a wide variety of cuisines and dining options, all available for delivery to one’s doorstep. This convenience factor is particularly appealing in today’s fast-paced world, where time is a valuable commodity. Additionally, delivery apps often offer promotional deals and discounts, further incentivizing consumers to order out rather than cook at home. For restaurants, partnering with these apps expands their reach beyond their physical locations, tapping into a broader customer base and increasing their sales volume. This synergy between convenience for consumers and expanded market access for restaurants drives the sustained growth of restaurant food consumption.

Point 3: Online Grocery Growth is Here to Stay

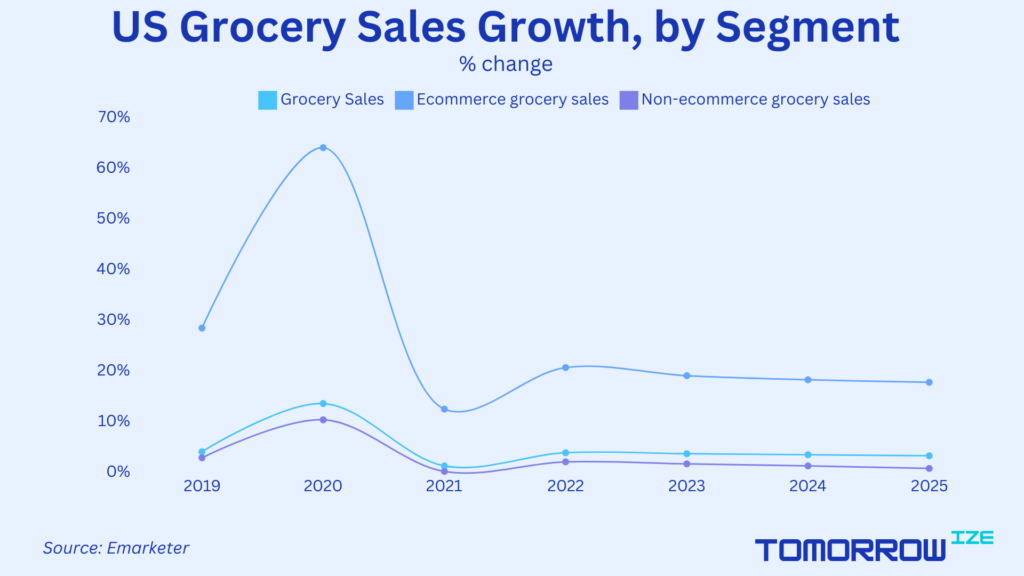

The growth of the grocery market in the US is increasingly shifting online, driven by consumer demand for convenience and efficiency. Online grocery sales are experiencing much faster growth compared to physical stores. Shoppers appreciate the ease of ordering groceries from their devices and having them delivered to their doorsteps, saving time and effort. This trend is further accelerated by advancements in logistics and delivery services, making online grocery shopping more reliable and accessible. Traditional grocery retailers who adapt by enhancing their online presence and delivery capabilities are likely to capture significant market share in this rapidly evolving landscape.

Point 4: Online Grocery Market Attracts New Players

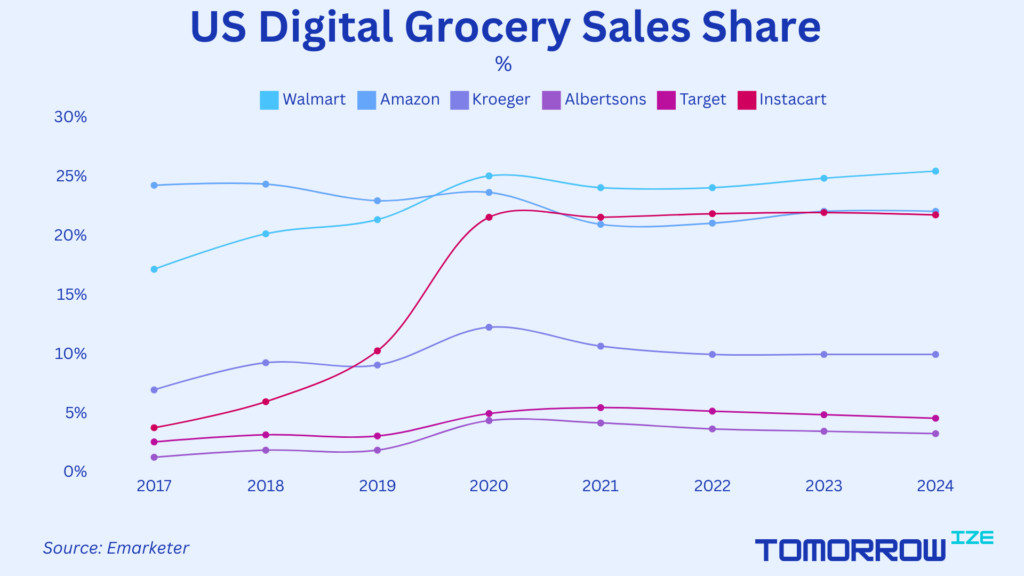

The rapid growth of the online grocery market has attracted significant new players, including giants like Amazon and specialized services like Instacart. These companies recognize the immense potential in meeting consumer demand for convenience and time-saving solutions. Amazon leverages its vast logistics network to offer swift and reliable grocery deliveries through Amazon Fresh and Whole Foods. Meanwhile, Instacart partners with multiple grocery chains to provide a seamless shopping experience. Their entry into the market not only increases competition but also drives innovation and improved service quality, further accelerating the shift from traditional grocery shopping to online platforms.

Winners and Losers

The current trends in food consumption and grocery shopping indicate clear winners and losers.

Winners

Delivery apps and online grocery services like Amazon Fresh and Instacart are capturing market share by offering unparalleled convenience and efficiency. Restaurants that partner with delivery platforms and adapt to the takeout model are also set to benefit.

Losers

Traditional grocery stores and dine-in-only restaurants that fail to innovate and incorporate digital solutions will likely lose ground.