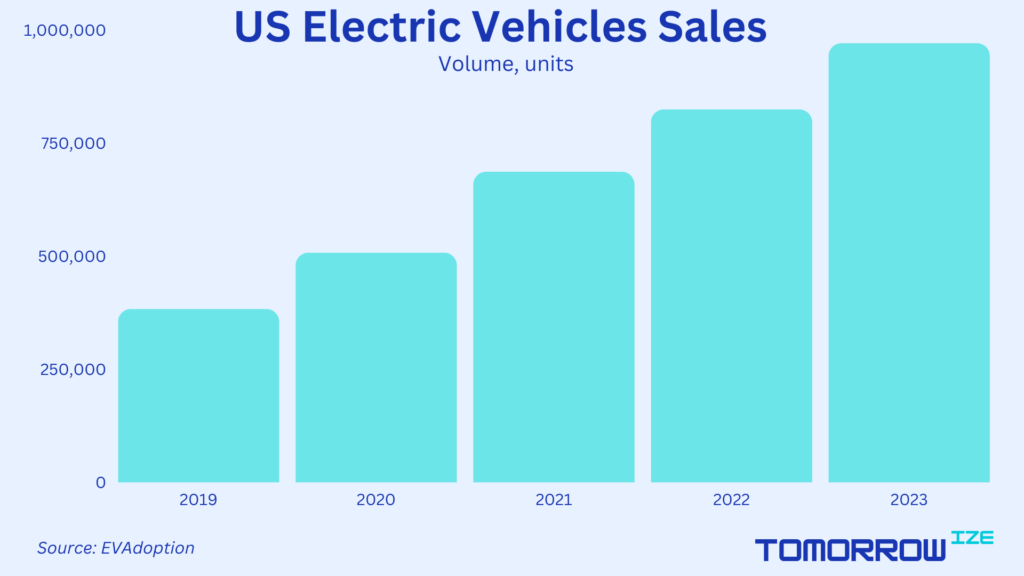

Point 1: EV cars are getting increasingly popular among consumers

Electric cars gained in popularity at the expense of traditional combustion engine cars. While battery electric cars (BEV) are still quite expensive, the affordability gap is closing swiftly. There is still a long way to go for the wide acceptance of electric cars. But it looks increasingly likely that the days of the mass production of combustion engine cars are numbered. Incumbent car manufacturers are late to the game and looking to catch up with electric newcomers.

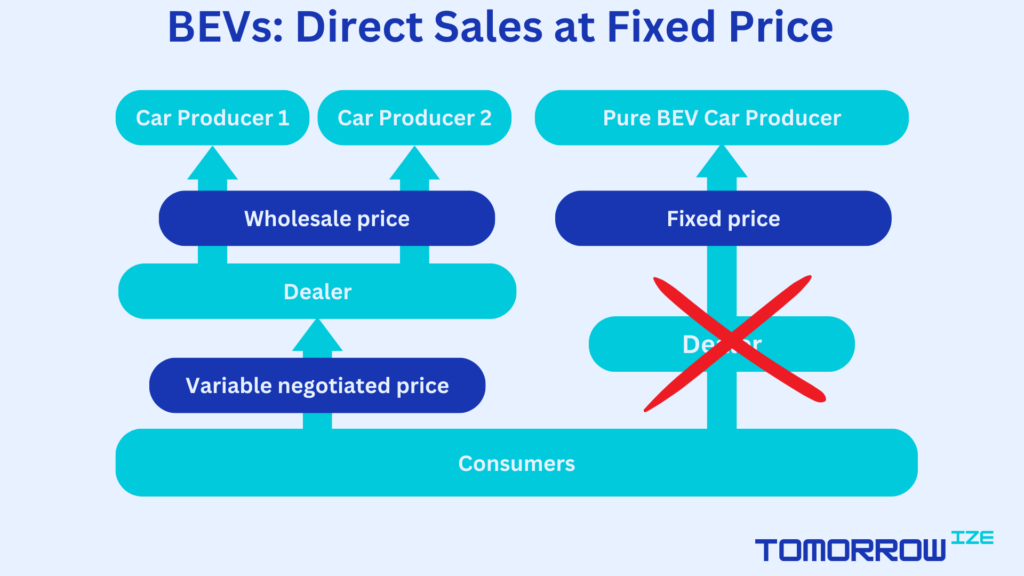

Point 2: Online sales at fixed priced disrupts new car sales process

Recently established electric car companies not only revolutionized the way the cars are made but also the way the cars are sold to consumers. The new selling approach may be called “pre-order online at a fixed price”. While the new pricing strategy might have had purely economic roots, it resonates well with the consumers. Increased transparency and predictability of the car purchase process online is a clear winner over the physical visit to the local car dealership.

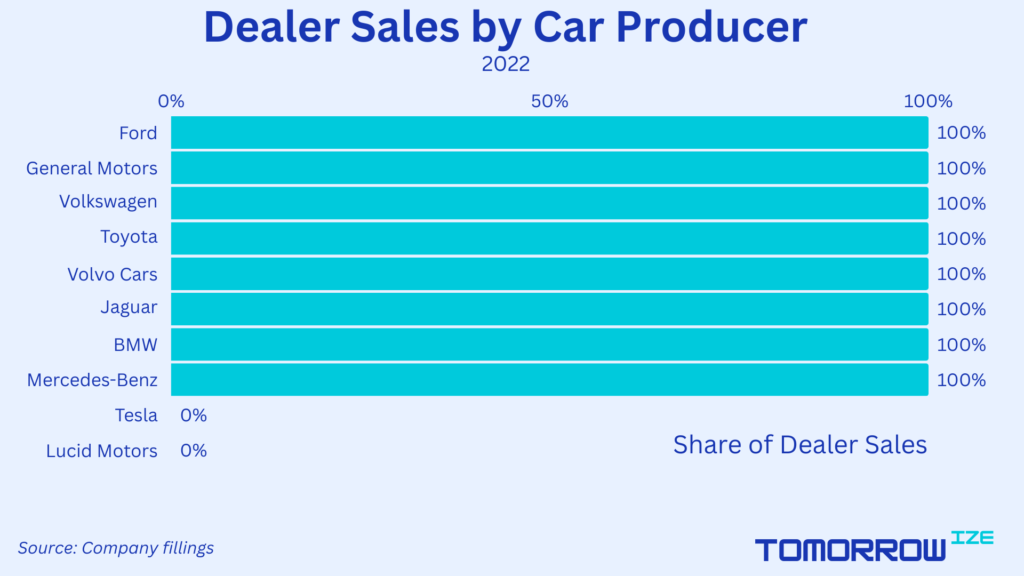

Point 3: Incumbent car producers rely exclusively on dealers

Incumbent car manufacturers took a note on the tectonic shifts in the sales process. Motivated by the better economics of the direct sales channels, many car companies announced plans to move BEV sales online. However, changing the dealership model is proving to be very tricky. Dealers want to stay relevant and want a part of the BEV cake. And recent announcements by the incumbent car manufacturers suggest that dealers’ message is being heard and they are indeed getting an invitation to the BEV party. It seems that incumbents will not be able to cut ties with the dealers in the foreseeable future and will have to share part of the BEV business with them. Pure-play BEV producers are well-positioned to benefit from absence of the middleman in their sales process.

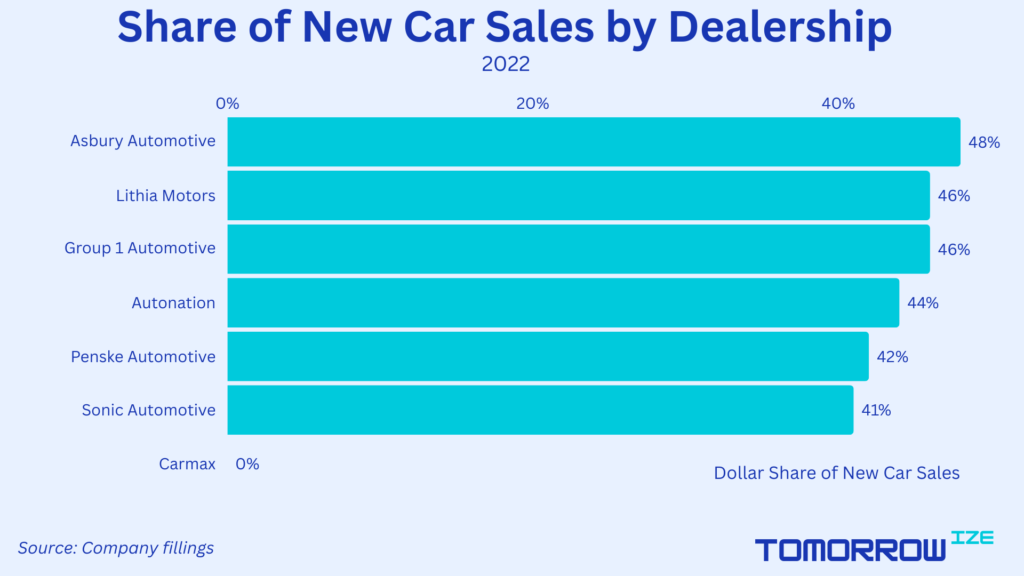

Point 4: Most of the dealers are very exposed to new car sales

The other side of the car producer – dealership marriage is that many dealerships are heavily dependent on the new car sales. Some dealers derive almost a half of sales from the new cars. And new car sales are very important due to cross-sell of high margin ancillary products and services. There has been a slow shift towards the used car market, but the space is crowded and growing business is by no means easy in this space. Again pure-play BEV producers are set to outcompete dealers in the new car sales games due to greater flexibility and vertical integration.